Prenuptial agreements in Florida are becoming increasingly popular each year. These legally binding agreements allow couples to make important decisions about finances, assets, and estate planning before entering into marriage. They provide an opportunity to protect significant assets, business interests, and income in the event of a divorce.

While prenuptial agreements offer many advantages, there are also some drawbacks to consider. One common issue is the “take it or leave it” approach often used by attorneys. Traditionally, many lawyers handle prenuptial agreements as they would any other legal matter, aiming to take everything for their client without any regard for the other person involved. This adversarial mindset may work in business disputes, but it is not suitable for couples preparing for marriage.

At our firm, we take a different approach. Instead of focusing on “taking or winning”, we prioritize educating you about your options under Florida law. We help you understand how to protect your assets, financial accounts, and business interests in the event of a divorce. We also educate you about how we can prepare your prenuptial agreement to assure that your family will receive whatever you desire to leave to them under your estate plan when you pass away.

Once we outline your options, we work with you to create a custom plan that meets your goals. We also involve your fiancé(e) early in the process to ensure they are not blindsided. Our experience shows that transparency and honesty provide the foundation necessary for both of you to be comfortable with the process.

Our goals are to help you avoid conflict during the process, and to accomplish your unique goals in preparing for marriage. We will help you to create a legally enforceable prenuptial agreement that does not damage your relationship with your fiancée. By working openly and honestly, we help you plan a life together, rather than undermining trust before your marriage.

Protecting Your Future with a Premarital Agreement

At Mindful Divorce P.A., we understand that marriage is one of life’s most important decisions. It’s a time filled with excitement and hope for the future, but it’s also a moment to consider practical steps to protect yourself and your assets.

In Florida, prenuptial agreements are referred to as premarital agreements.

While no one enters a marriage expecting it to end, having a prenup in place can save you significant stress and uncertainty down the line.

As a law firm focused on family matters, we offer fixed-fee services and a client-first approach to ensure your prenup reflects your unique needs. If you’re ready to talk further, you can schedule a consultation now.

Otherwise, let’s jump in and explore what a prenuptial agreement can do for you and how we can help.

What Is a Prenuptial Agreement?

A prenuptial agreement, often called a prenup, is a written contract between two people planning to marry. It outlines how assets, debts, and financial responsibilities will be handled during the marriage and in the event of a divorce or death.

Prenuptial agreements have a rich history dating back to ancient civilizations, with early forms documented in ancient Egypt and Jewish traditions. However, their legal recognition in the United States was limited until the late 20th century. A significant turning point came in 1981 with the landmark case of Osborne v. Osborne, where the Massachusetts Supreme Judicial Court sanctioned divorce prenuptials, paving the way for broader acceptance and enforceability of these agreements across the country.

Prenups aren’t just for the wealthy. Whether you’re entering a second marriage, have children from a prior relationship, or simply want to protect premarital assets, a prenuptial agreement can provide peace of mind.

Why Consider a Prenuptial Agreement in Florida?

Florida’s family laws can be complex, particularly when it comes to property division and alimony. A prenuptial agreement allows you to take control of these issues instead of leaving them up to the courts.

Here are a few reasons you might consider a prenup:

- Protecting Premarital Assets: Keep what you owned before the marriage separate, such as real estate, investments, or retirement accounts.

- Avoiding Property Disputes: Clearly define marital property versus separate property.

- Safeguarding Family Inheritances or Businesses: Ensure that family heirlooms, businesses, or inheritances stay in the family.

- Managing Debt Responsibilities: Prevent being held liable for your spouse’s debt.

- Ensuring Fairness in Alimony Discussions: Agree on spousal support terms in advance.

A prenuptial agreement isn’t just about protecting yourself—it’s about setting clear expectations and avoiding misunderstandings.

What Can Be Included in a Prenuptial Agreement?

Prenups are flexible documents that can cover various financial and legal topics. Here are some common elements:

- Division of Property: Define what will happen to assets acquired before and during the marriage.

- Spousal Support (Alimony): Decide whether spousal support will be waived or established in advance.

- Estate Planning: Clarify how your assets will be distributed upon death, ensuring the protection of children from previous relationships.

- Business Interests: Protect ownership of a business or professional practice.

It’s worth noting that certain matters—like child custody and support—cannot legally be included in a prenuptial agreement.

The Prenuptial Agreement Process in Florida

Creating a valid prenup requires careful attention to Florida law. Many states rely on the Uniform Prenuptial Agreement Act (UPAA) to establish guidelines for enforcing prenuptial agreements, and Florida adopted this framework in 2007. The UPAA provides courts with clear rules to assess the validity of these agreements.

While closely aligned with the original UPAA, Florida’s version includes key variations, such as allowing spousal support terms to be established in the agreement and providing grounds to deem an agreement unenforceable if obtained through fraud, duress, or coercion.

How the Prenup Agreement Process works

- Full Financial Disclosure: Both parties must disclose all assets, debts, and income.

- Independent Legal Counsel: Each party should have its own attorney to avoid conflicts of interest.

- Voluntary Agreement: A prenup must be signed willingly, without coercion or duress.

- Written and Executed Properly: The agreement must be in writing, signed, and witnessed appropriately.

We recommend starting the process well before your wedding to avoid rushed decisions and ensure a thorough review.

Common Misconceptions About Prenuptial Agreements

Many people hesitate to consider a prenup due to misunderstandings. Let’s address a few myths:

- “Prenups are only for the wealthy.” Not true—anyone can benefit from one, regardless of financial status.

- “Having a prenup means you’re planning for divorce.” Think of it as planning for fairness, not failure.

- “Prenups are unromantic.” Discussing financial expectations shows mutual respect and transparency.

A well-prepared prenuptial agreement builds trust and helps create a solid financial partnership. In 2023, Axios found that 50% of adults are open to signing a prenup, showing its increasing popularity.

Frequently Asked Questions

Are couples who enter into a prenuptial agreement more likely to divorce?

Some studies indicate that discussing and establishing a prenuptial agreement can lead to open communication about financial matters, which may strengthen the relationship. For instance, a survey by HelloPrenup found that 83.81% of respondents felt more connected to their partner after completing the prenup process.

Can we modify our prenup after marriage?

In Florida, you can update your prenuptial agreement after marriage with a written and notarized amendment agreed to by both spouses, or you can create a new postnuptial agreement.

Do both parties need separate lawyers when doing a prenup agreement?

While not universally mandated by law, it is strongly recommended that both parties have separate legal representation when entering into a prenuptial agreement.

Will a prenup protect future assets or inheritances?

Yes, a prenuptial agreement can protect future assets and inheritances by specifying that they remain separate property and aren’t divided during a divorce.

How Mindful Divorce P.A. Can Help

At Mindful Divorce P.A., we’re here to guide you every step of the way. Our services include:

- Drafting and reviewing prenuptial agreements.

- Providing personalized advice to address your specific needs.

- Ensuring the agreement complies with Florida law and remains enforceable.

- Facilitating discussions to keep the process smooth and stress-free.

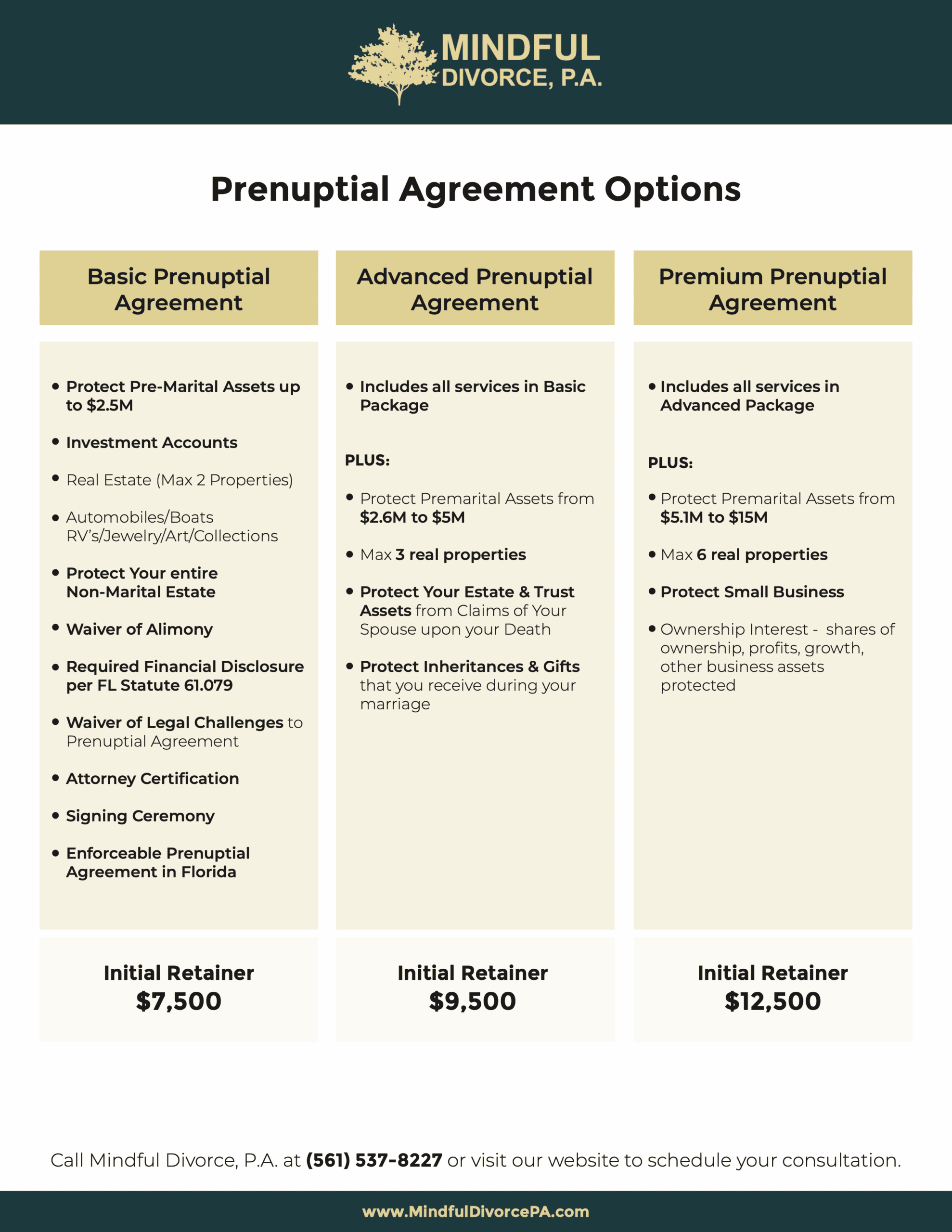

We also offer fixed-fee schedules, so you know exactly what to expect.

Call us today at (561) 834-3349 or book a consultation online to start drafting your prenuptial agreement.

|

Description of Services |

Fixed Attorney Fee |

|

1. Protected Assets Valued under one million dolllars. |

$4,000.00 (Prenuptial Agreement under one million assets) |

|

2. Protected Assets Valued under $2.5 million dollars. |

$5,500.00 (Prenuptial Agreement under 2.5 million assets) |

|

3. Protected Assets Valued under $4.5 million dollars. |

$7,500.00 (Prenuptial Agreement under 4.5 million assets) |

|

4. Protected Assets Valued above $4.5 million. |

$9,000.00 (Over 4.5 million assets) |

The fixed fee pricing above provides an estimate of attorneys fees and may vary depending upon your unique situation. It is meant to allow potential clients with an estimate of what their prenuptial agreement may cost depending on their circumstances.

Upon meeting with us, we will provide you with a written fee agreement to retain Mindful Divorce, P.A. to represent you and prepare your prenuptial agreement. Your signed employment agreement will be based on the specific circumstances of your case as discussed with your attorney.